5 Steps to Get Financially Organized for the New Year

January is one of my favorite months, because like most of you, I like a fresh start! It’s the time of year when I get back on track with my financial goals, and start thinking about getting my finances organized.

I’ve tried just about every organization method out there to try to get my finances organized. Finally after combining a number of great systems, I have a financial organization system that works! I’m going to show you how you can organize your finances, so you can start off your new year on the right foot!

Organize your Files

Over the course of the year, you will have more documents and statements than you know what to do with! There are bills, tax return documents and all kinds of papers to keep organized!

While you may be able to toss some of these after a short period, most of these will have to stay for the long haul. Keep your files organized with my file cabinet organization method, and you won’t be trying to tackle a box full of papers at the end of the year.

Keep Track of your Bills

In just one month, your mailbox is full of bills, documents, and other items. This doesn’t even take into account anything you do online or the automatic payments! It’s so easy to get off track when things get disorganized.

Wherever you go to pay bills and handle finances, keep a bill tracker as well as an income tracker so you’ll always know what money has come in and what has gone out. This will keep you from spending money you don’t have, and budgeting for bills that aren’t due until later in the month.

Don’t Forget about Debt

Debt is one of the easiest expenses to forget about. We interact with our phones every day and drive our cars, which make expenses such as gas and phone bills easy to remember. Since our debt comes from purchases in our past, it’s easy to forget about them. This can make it easy to miss payments and accrue even more debt!

Print out a debt tracker and keep it somewhere prominent. This will help make sure that you don’t forget to make those payments, and keep you motivated to become debt free.

Keep Track of Your Accounts

If you have multiple bank accounts, loans, and other financial accounts, it can be easy to not check in regularly. In order to be organized, you need to be able to look at all of these easily at a glance. Start by listing out all the accounts you have. Focus on the ones that have monetary value, or ones you owe money to. Don’t forget accounts such as investment or retirement accounts.

Once you have them listed, organize them in a spreadsheet or online tool. This will help you better manage your money and track where your money is going.

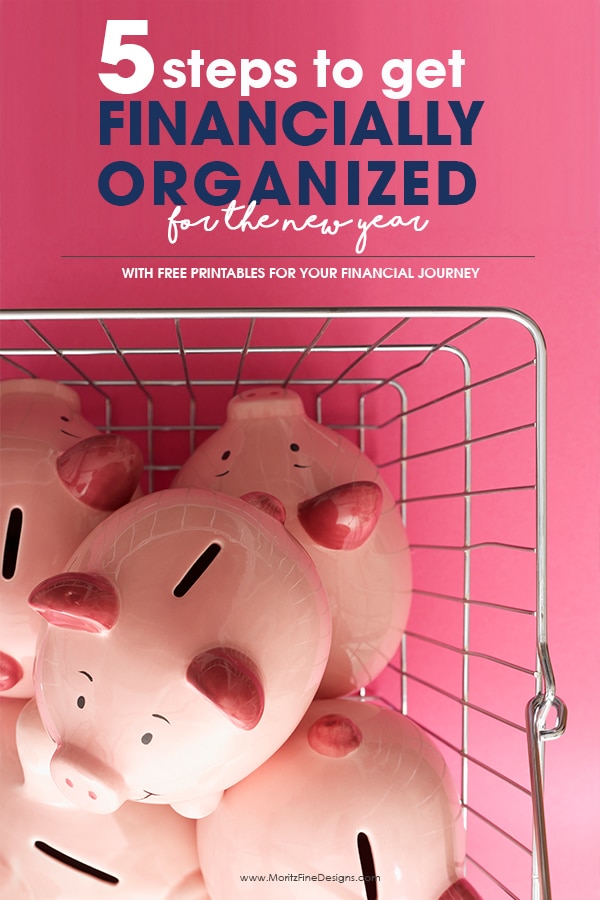

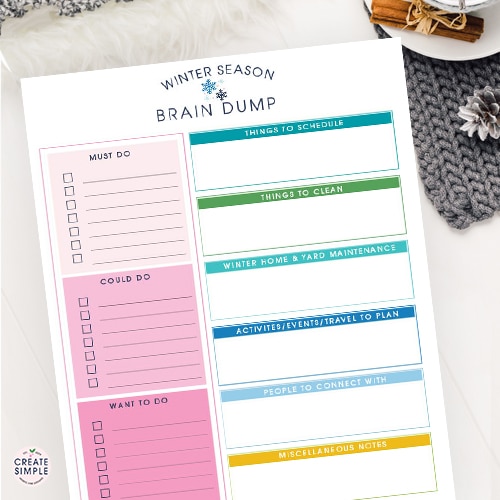

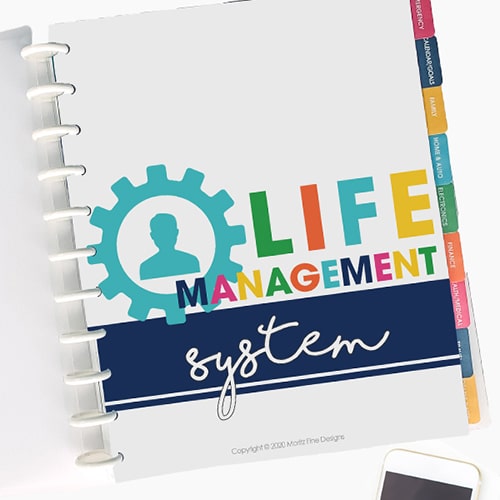

Organize Everything in One Central Location

Ultimately my best solution has been to being using the Life Management Binder. I created this binder to keep me on track and it’s been an amazing solution. Now I simply keep it on my desk by my computer at all times. It’s my go-to for everything I need home related.

There is a financial section in the Life Management Binder where I keep the bill tracker, income tracker, debt tracker all of which are included in the binder along with a credit card tracker, bank account tracker and donation record.

Money is one of the most difficult things to organize. Most of us probably spend money almost every single day, making it difficult to keep up with tracking methods and organization tactics. If you follow these tips, you won’t just stay organized but you’ll also be able to manage your money better!

IT IS POSSIBLE TO

ENJOY STRESS FREE HOLIDAYS THIS YEAR!

The holiday season can be downright exhausting. We have too many things to do and not enough time to get them done. The 2024 HOLIDAY PLANNER will not only help you get organized, but will also help melt away that holiday stress so that you can actually enjoy the season!